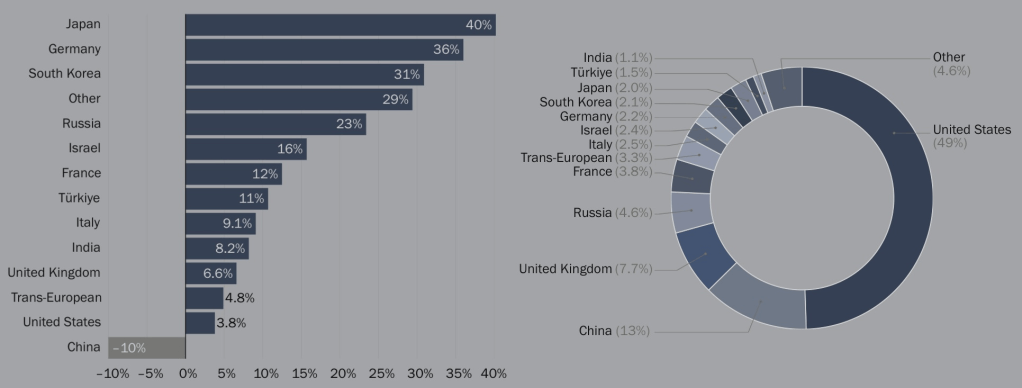

As per the Stockholm International Peace Research Institute (SIPRI) report dated 01 December 2025, global arms revenues soared in 2024, driven by the wars in Ukraine and Gaza, escalating geopolitical tensions, and rising military spending. For the first time since 2018, all five of the largest arms companies reported increased revenue. Although most global growth came from European and US firms, all regions in the Top 100 saw year-over-year gains, except Asia and Oceania, where issues within the Chinese arms industry dragged down the regional total. The revenue surge and new orders led many arms companies to expand production lines, grow facilities, establish new subsidiaries, or acquire other firms.

The 2024 saw global arms revenues reaching the highest point ever recorded as producers capitalized on strong demand. The US arms revenues grew by 3.8% to $334 billion, with 30 of the 39 US companies in the Top 100 increasing their military sales. Major defence contractors like Lockheed Martin, Northrop Grumman, and General Dynamics all saw gains.

In Europe, 23 of the 26 arms companies in the Top 100 reported revenue increases, totaling a 13% rise to $151 billion, largely driven by demand related to the Ukraine war and perceived threats from Russia. Czechoslovak Group in the Czech Republic saw the largest percentage increase at 193%, reaching $3.6 billion, mainly thanks to supply contracts for Ukraine. Ukraine’s own state defence company increased revenue by 41% to $3 billion.

The biggest challenge for almost all the non-Chinese companies would be sourcing materials, especially critical minerals. Dependence on such resources is likely to complicate their rearmament plans. For example, Airbus and Safran sourced half of their pre-2022 titanium needs from Russia and are now seeking new suppliers. Amid Chinese export restrictions on critical minerals, companies like Thales and Rheinmetall warn of higher costs tied to restructuring their supply chains.

Russian arms revenues grew despite sanctions and skilled labor shortages. Rostec and United Shipbuilding Corporation increased their combined revenues by 23% to $31.2 billion, with domestic demand compensating for declines in exports. Besides sanctions, Russian arms firms face a shortage of skilled labor, which could slow production and limit innovation. Russia’s arms industry has shown resilience amid the war in Ukraine, defying expectations.

For the first time, nine companies in the Middle East made the Top 100, with revenues totaling $31 billion, a 14% increase. Israeli companies saw a 16% increase to $16.2 billion. Despite backlash over Israel’s actions in Gaza, many countries kept ordering Israeli weapons. Five Turkish firms and the UAE’s EDGE Group also made the list, with revenues of $10.1 billion and $4.7 billion respectively. Indonesian firm DEFEND ID entered the Top 100 with a 39% increase, reaching $1.1 billion, supported by consolidation and increased domestic procurement. Even the much-celebrated SpaceX appeared on the list for the first time, with revenues more than doubling to $1.8 billion.

Why China’s Decline Threatens India

India, though still far from being a global arms giant, posted a quiet but steady 8.2% increase in combined revenues across its three Top 100 companies. In sharp contrast, Chinese arms revenues fell 10%, a setback tied to a wave of high-profile corruption scandals and major contract delays that rattled Beijing’s defence establishment. India’s three firms among the Top-100 firms are — Hindustan Aeronautics Ltd (HAL), Bharat Electronics Ltd (BEL), and Mazagon Dock Shipbuilders. Together they pulled in $7.5 billion in arms revenue in 2024, up from $6.9 billion in 2023.

BEL led the growth with a 24% revenue jump, reaching $2.47 billion. The rise was driven by domestic orders, especially in radar systems and electronic warfare equipment.

HAL, India’s top-ranked defence firm at rank 44 globally, earned $3.81 billion, a slight 0.3% decrease from the previous year. Despite delivery delays, it remained a key supplier for the Indian Air Force and Navy. At number 91, Mazagon Dock, focused on naval shipbuilding, reported $1.23 billion in arms revenue, a 9.8% increase year-on-year, thanks to ongoing submarine and destroyer production.

India continues to advance its “Atmanirbhar Bharat” (self-reliant India) campaign in defence manufacturing. While not garnering global headlines, its gradual gains reveal an emerging industrial base that could challenge traditional suppliers over time.

China’s largest decline was seen in NORINCO, the primary land systems manufacturer. NORINCO saw its revenue drop 31% due to corruption scandals and leadership issues. CASC, China’s leader in aerospace and missile systems, slid 16% following delays in military satellite programs and the removal of its president amid graft allegations. Even AVIC, the country’s biggest defence company, fell 1.3%, hindered by delays in aircraft deliveries.

China’s top-down, state-controlled defence sector may be large—but its lack of transparency makes it vulnerable to internal shocks. Political purges linked to Xi’s sweeping anti-corruption campaign disrupted procurement and leadership pipelines across several top defence firms.

Only two of China’s eight arms producers showed revenue growth-CSSC, the shipbuilding powerhouse, increased by 8.7%, aligning with China’s naval expansion in the South China Sea. Yet, China leads in sheer scale accounting for around 13% of the Top-100 revenues, as its vulnerabilities are exposed to internal instability.

However, the 2024 rankings suggest a temporary pause or reordering in its modernization efforts, just as tensions over Taiwan and in the South China Sea remain high. Recovery will depend on restoring procurement integrity, managing talent loss, containing political fallout, and increasing hype around Chinese military platforms.

The bottom line: India is climbing steadily—fueled by trust in institutions, steady demand, and political will. China, long considered an unstoppable defence powerhouse, now faces turbulence not from external threats but from within. Whatever it may be, it does not augur well for India. China since 2020 has placed 25 J-10C fighter jets, four Type 054A/P frigates, eight Type 039B submarines (deliveries to begin in 2026), along with tanks, air defence systems, and armored vehicles in Pakistan.

The 2025 U.S.-China Economic and Security Review Commission’s report stopped short of accusing China of orchestrating the Pahalgam massacre of 26 civilians in Jammu and Kashmir in April 2025. However, it did accuse China of exploiting the India-Pakistan conflict to test and showcase its weapons, in the context of its border tensions with India and its 2024 defence industry decline shocker.

The next Chinese, move is to position 40 J-35A low-observation fighter jets, PL-17 AAMs, and better air defence systems in Pakistan and 20 JF-17 (or J-10C) in Bangladesh (incidentally Bangladesh is reviving a World War II airfield, Lalmonirhat, just 20 km from the Indian border. At that airfield a hangar is under construction that can house 10-12 fighters. Revival of another World War II airfield, Thakurgaon is under consideration.). Once again J-35As are unproven platforms and the world saw through the Chinese propaganda surrounding J-10C. So China is desperate to create circumstances for testing these platforms against India.

Another war between India again a duo of Pakistan-Bangladesh will serve a dual purpose. It will showcase the prowess of Chinese military platforms to the world and stem the declining sales of the Chinese defence giants. But the moot question remains — Is India ready for a two-front indirect ‘War with China?’

Leave a reply to Commander Sandeep Dhawan (Veteran) Cancel reply